More thoughts on buying Marriott elite status

/Way back in July of last year I wrote a kind of silly thought experiment about buying United Premier Silver status by status matching to Marriott Platinum elite status and then taking advantage of the RewardsPlus partnership between the two programs. That post has no comments so I have no idea whether anyone liked the idea or not, but I do remember reading some reports of success with the technique on Flyertalk.

This year I've had cause to start thinking about a slightly different thought experiment. I carry a Chase Marriott Rewards Premier card, which comes with 15 "bonus nights," which count towards elite status each year. Additionally, the card awards 1 "bonus night" for every $3,000 spend on the card. That means that in order to achieve mid-tier Gold status you would need to spend $105,000 on the Premier card, and to achieve top-tier Platinum status (and United Premier Silver) you would need to spend $180,000 on the card.

That's patently insane.

On the other hand, if you had already earned 49 elite-qualifying nights, you would have to almost-equally crazy to not spend $12 (for example) to put an additional $3,000 in spend on the card and earn Gold elite status through the end of the next program year.

Which got me to thinking: wouldn't it be nice to know the break-even point, where the amount you would need to spend on the Premier card in order to achieve the next level of elite status is justified by the additional benefits of that status?

The Model

For the sake of modeling, I'm forced to make a few assumptions, the most important of which is that the number of paid nights you stay this year is a good predictor of the number of paid nights you'll stay next year. After all, if you won't make any paid stays next year, then it wouldn't matter if elite status were free; it still wouldn't be worth anything.

Next, remember that on paid Marriott stays, you'll earn 10 Marriott Rewards points per dollar, plus 20% bonus points as a Silver elite, 25% bonus points as a Gold elite, and 50% bonus points as a Platinum elite. Since the Premier card comes with Silver elite status, spending up to Gold earns a bonus of 4.17% over Silver, and spending up to Platinum earns a bonus of 20% over Gold status.

Here are the two most extreme examples of buying up to Gold status:

- 15 "bonus nights," 0 paid nights: $105,000, no bonus points;

- 15 "bonus nights," 34 paid nights: $3,000, 4.17% bonus on 34 paid nights.

And here are two extreme examples of buying up to Platinum status:

- 15 "bonus nights," 35 paid nights: $75,000, 20% bonus on 35 paid nights;

- 15 "bonus nights," 59 paid nights, $3,000, 20% bonus on 59 paid nights.

An Example

This year based on my current reservations I'll have 24 elite qualifying nights, meaning I'd have to spend $78,000 to earn Gold elite status, and $153,000 to earn Platinum elite status.

Based on the 7 paid nights I've already earning this year, at an average of $76.04 per night:

- Gold status would earn an additional 342 Marriott Rewards points, a rounding error;

- Platinum status would earn an additional 1711 Marriott Rewards points, or roughly 1.01 Marriott Rewards points per dollar spend on the Premier card.

The Data

I hate to admit it, but I can't give you the "break-even" point I promised above. Your break-even point will depend entirely on the value you put on Marriott Rewards points (and the other benefits of elite status).

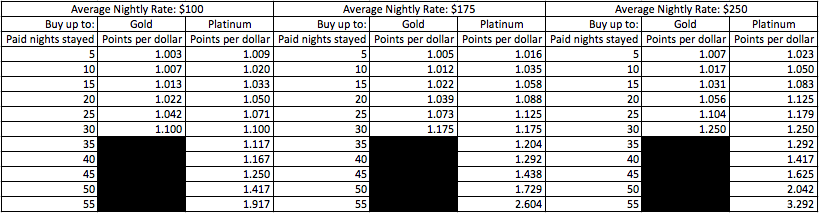

What I can do is give you a simple tool that allows you to determine your own break-even point. You can use the following chart, and your own valuation of Marriott Rewards points, elite benefits like free continental breakfast, upgrades, access to club lounges, and United Premier Silver status to decide whether buying up is right for you:

This chart translates the bonus points you earn from your newly acquired elite status into "points per dollar" earned with your Marriott Rewards Premier credit card. The intuition is that while you're only technically earning 1 Marriott Rewards point per dollar spent on the card, the elite bonus points you earn as a Gold or Platinum elite are also in some sense "earned" by your credit card spend.